July 28, 2023 · 6 Minutes

Investing in the secondary market

The majority of real estate investments are long-term, especially real estate equity investments – when a secured real estate loan might be ending in just 12 months, the tenor of real estate equity investments can be several years. When making a long-term investment decision, having a backup plan for early exit is one of the important topics every investor has in its mind.

Crowdestate was one of the very first global real estate crowdfunding platforms that launched its secondary market in early 2018, and thousands of investments have exchanged their ownership there.

The original idea behind launching the secondary market was the creation of emergency exit opportunities for investors in true need. While one of the key investment principles is to invest only the money that you do not need to touch during the investment period, we are all aware of extreme emergencies that might call for the urgent liquidation of one or several investments. Surprisingly to us, investors started using the secondary market as the speculative marketplace to sell their recently acquired investments to new investors at a premium.

There are two key things any investor can do on Crowdestate’s secondary market:

- sell his/her current investments before their exit date, and

- buy investments offered the secondary market to grow their portfolio.

Selling the investments on the secondary market

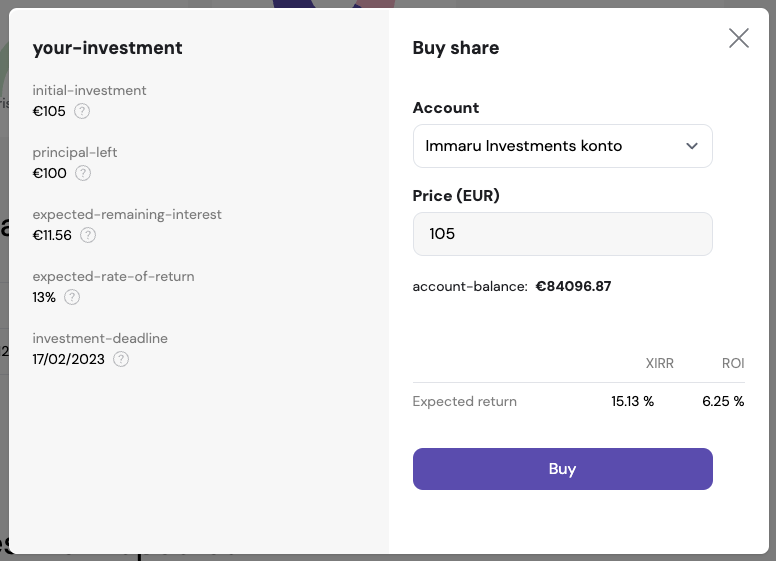

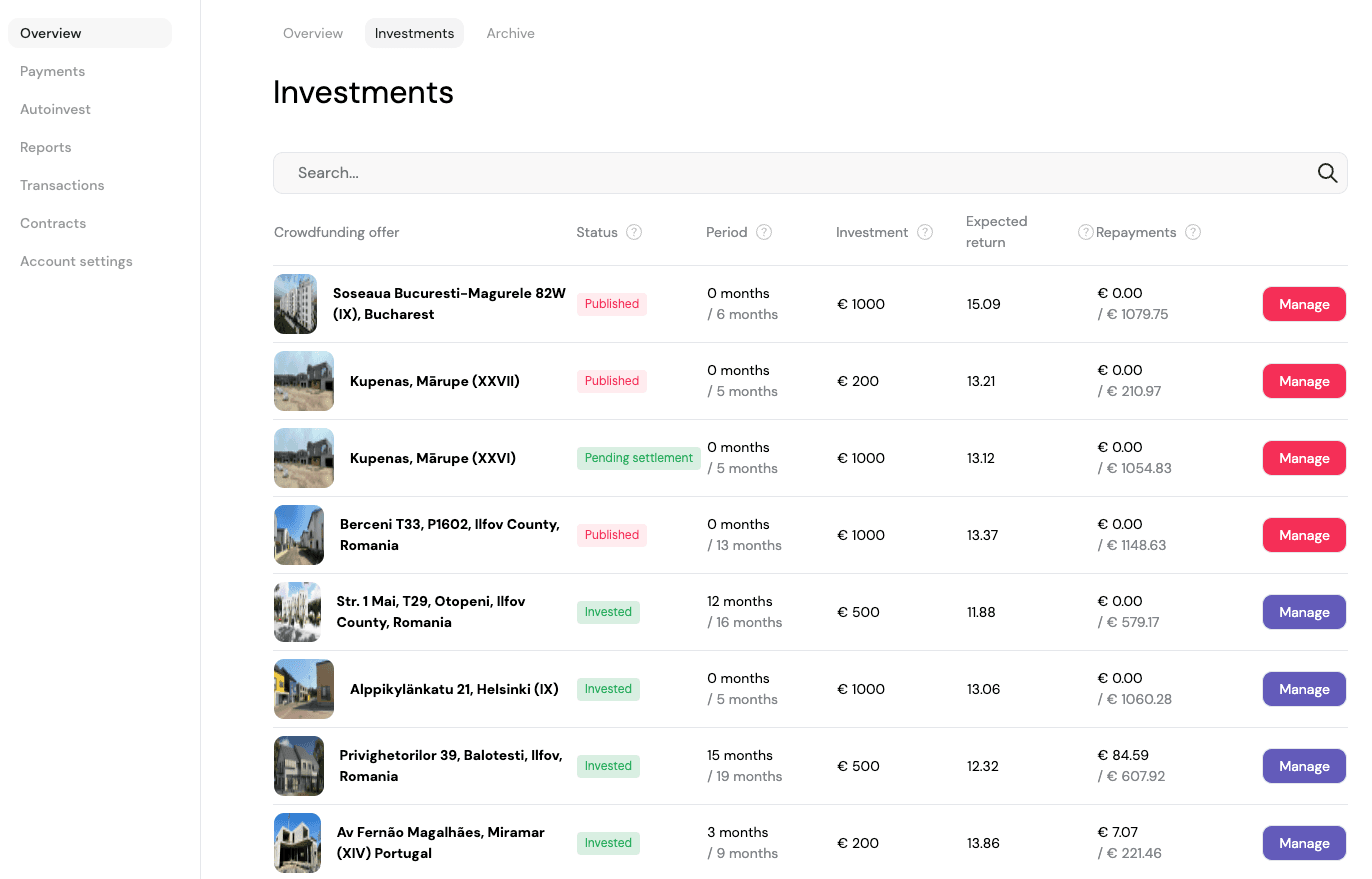

Selling the current investments is an easy and straightforward process – investors should start from their portfolio overview, then click on “Investments”, then select the investment they intend to sell and start the sales process by clicking on the “Manage” button.

Please note only the investments with the status of “Invested” or a violet “Manage” button can be traded on the secondary market.

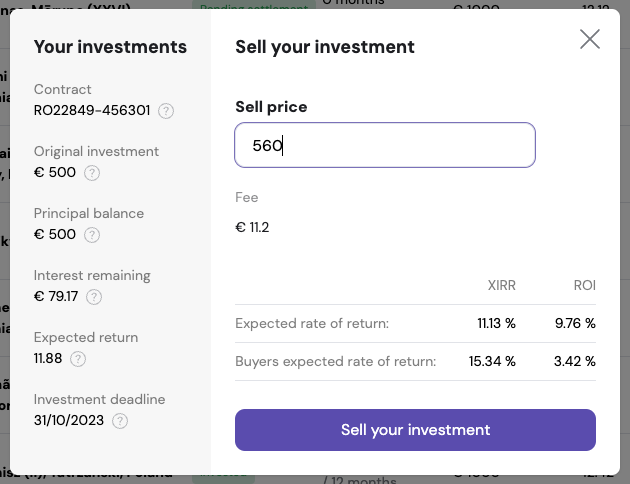

On the following screen, the only important step is to set a sales price. Crowdestate provides its investors with calculations estimating the returns of both the seller as well as the buyer.

When setting the sales price, the most important number to look at is the buyer’s expected return (XIRR) – if the seller is greedy and sets the price at a level that does not leave any reasonable profit for the buyer, the investment is technically priced out of the market and will probably remain unsold. To ensure a quick sales transaction, the investment should be priced at a price that leaves a reasonable amount of profit to the buyer as well.

When submitting an investment sales offer, please take a look at the currently published crowdfunding offers and price your sales offer accordingly. When there are several crowdfunding offers providing investors with a 15% annual return, your sales price should provide the potential buyer with 15% XIRR or more to be attractive.

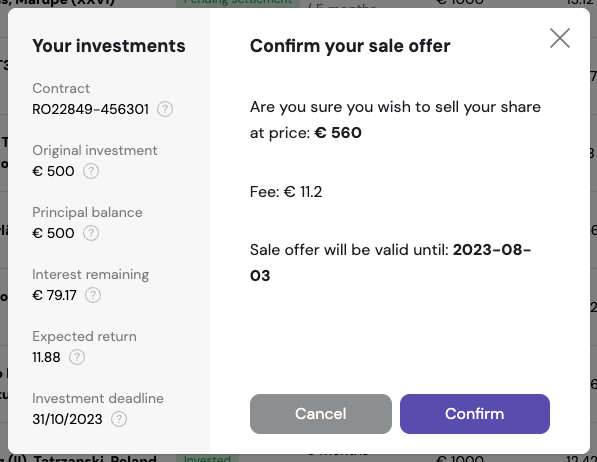

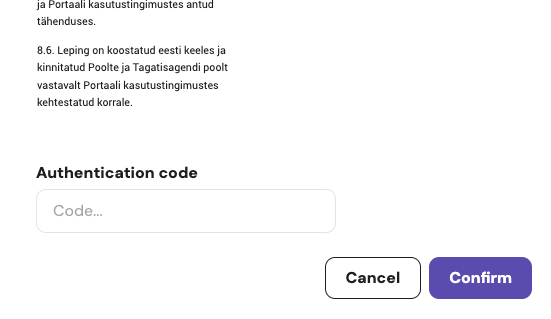

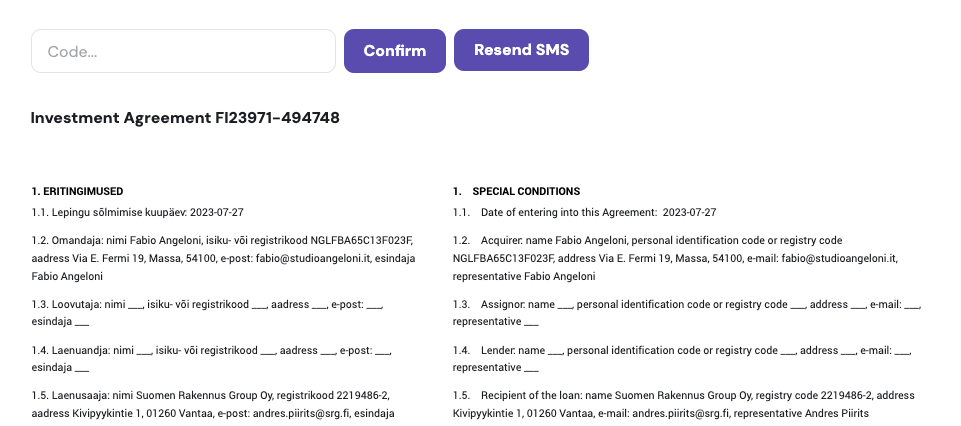

All sales offers are to be confirmed by the investor’s 2FA and remain valid for 1 week.

Enter your 2FA authentication code at the end of the displayed claims transfer contract and click “Confirm” to approve the sales contract.

The unsuccessful sales offers become invalid in 7 days and will be removed from the secondary market automatically. The investors are welcome to submit their new sales orders after that again.

Buying the investments from the secondary market

Buying the investments from the secondary market is even easier than putting up a sales offer.

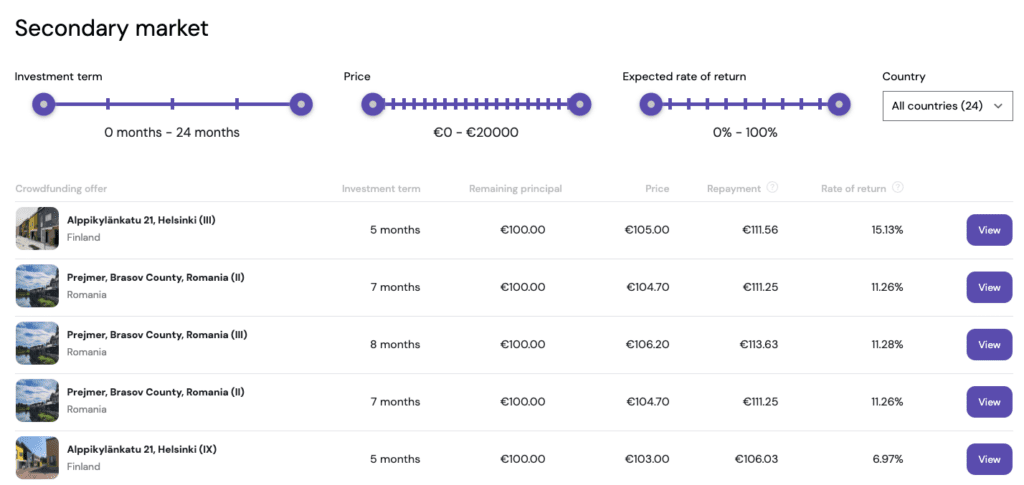

Select “Secondary market” from the main menu.

You will see the list of investment offers submitted to the secondary market.

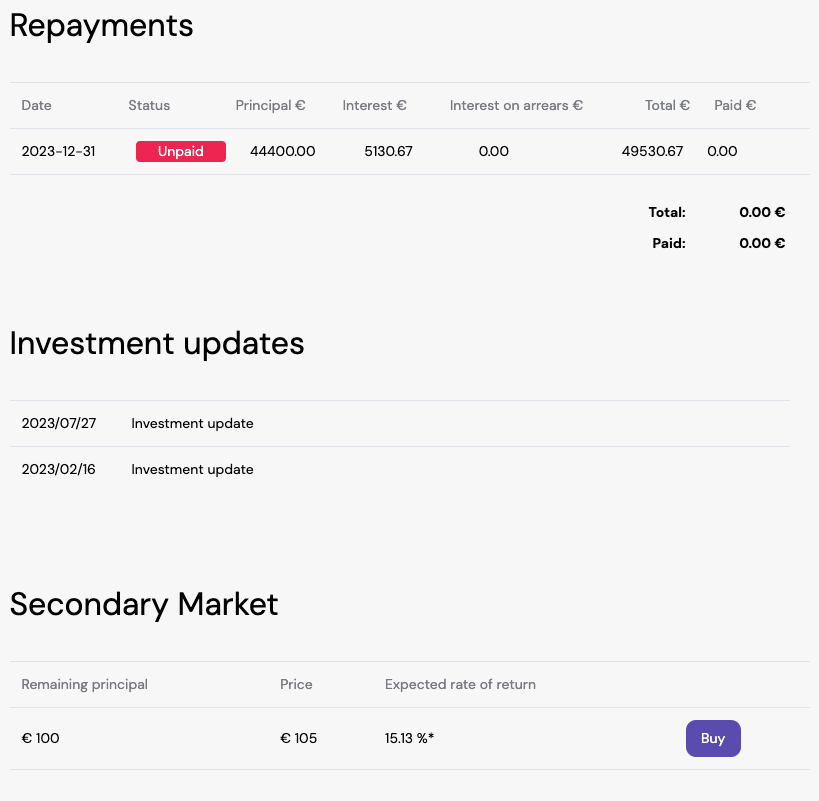

Browse and filter the available real estate investment opportunities to find the ones that would fit with the risk tolerance and expected return requirements. The buying transaction can be initiated by clicking on the “View” button, which takes you to the crowdfunding offer’s web page. Please get acquainted with the crowdfunding offer you intend to invest in, and pay special attention to the “Repayments” and “Investment updates” sections.

If this crowdfunding offer corresponds to your return expectations and risk tolerance, click on the “Buy” button to proceed.

All purchase orders are confirmed by the investor’s 2FA and are executed immediately. Please note that the buyer’s investment account should have enough funds to conclude the transaction.

When buying investments from the secondary market, investors should pay attention to at least the following items:

- review the original project and read the project updates to understand the project’s progress;

- review the investment’s sales price and its components (principal and accrued interest). If the investment is sold above the value of the original loan principal, the purchase of this investment will result in an accounting loss. At the same time, the accrued and future interest is fully taxable, thus diminishing the buyer’s net returns. In the worst case (when the due date is very close and the buyer acquires the investment above principal value), the transaction might even result in an actual loss. Doing the math before the acquisition is highly recommended.

- evaluate the attractiveness of the final return – is that adequate, or maybe it is too low? In lots of cases, there are attractively priced investments available on the primary market, so investing there might actually make more sense.

Why do we not offer automatching?

Automatching is a common feature, that collects the sellers’ sales orders and buyers’ purchase orders and conducts an automatic matching process. Unfortunately, real estate crowdfunding platforms are not allowed to implement automatching features due to the regulative restrictions. The use of automatching is limited to licensed stock exchanges, and the implementation of the automatching feature would require the obtaining of a stock exchange license.

Summary

- Crowdestate’s secondary market brings immediate liquidity to your long-term real estate investments;

- When selling your investments, price them in a way that leaves enough profit for the buyer – otherwise, there might be no buyers;

- When buying investments from the secondary market, pay attention to the details like expected return and taxation to make sure they correspond to your expectations.