July 4, 2023 · 6 Minutes

All you should know about tax residency certificates

What is the tax residency certificate?

A Tax Residency Certificate (or a Certificate of Fiscal Residence) is a certificate issued by the local tax authority (tax department, fiscal authority, internal revenue service etc) to a resident, either a private person or a company, proving that the person is a tax resident of that country.

The person shall have to fulfil several criteria to be qualified as a tax resident, and the most common of them are:

- the person’s place of permanent residence is in that country and

- the person is staying in that country for at least 183 days over the course of a period of 12 consecutive calendar months.

A tax residency certificate is a document of a specific form, please see the sample documents provided below. Your income tax declaration, utility bill, bank account statement etc. documents are not tax residency certificated and can not fulfil the purpose of the certificate.

Why is the tax residency certificate important?

If you earn foreign income, you may be subject to tax in that foreign country/region. For instance, being a tax resident of Italy and investing in Portugal, your investment income earned from Portugal is subject to a Portuguese withholding tax.

However, you may claim tax benefits if there is a double taxation treaty between your country of residence and the country where you have made your investment. To enjoy the potential tax benefits, mostly in the form of reduced or eliminated withholding tax, you should prove that you are a tax resident of your country.

How to obtain your tax residency certificate?

The tax residency certificate is issued by your home country’s tax department. In most cases, you will be able to download your or your company’s tax residency certificate from the tax department’s website. In some cases, you will have to submit an application to the tax authority to issue you the certificate.

The most up-to-date information on obtaining a tax residency certificate is available on your home country’s tax department’s website.

What to do with your tax residency certificate?

After you have obtained your tax residency certificate, please start by selecting your appropriate investment account by clicking on the “Portfolio” button in the upper right menu:

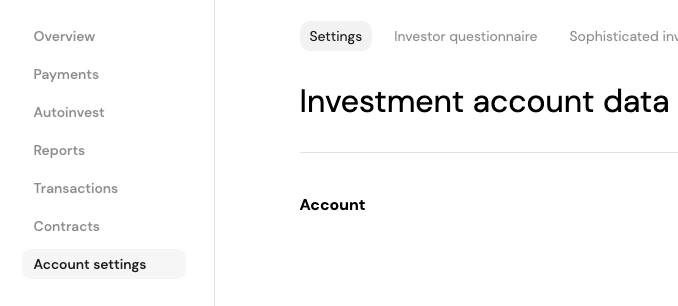

Next, click on “Account settings” in the left menu to navigate straight to the right section:

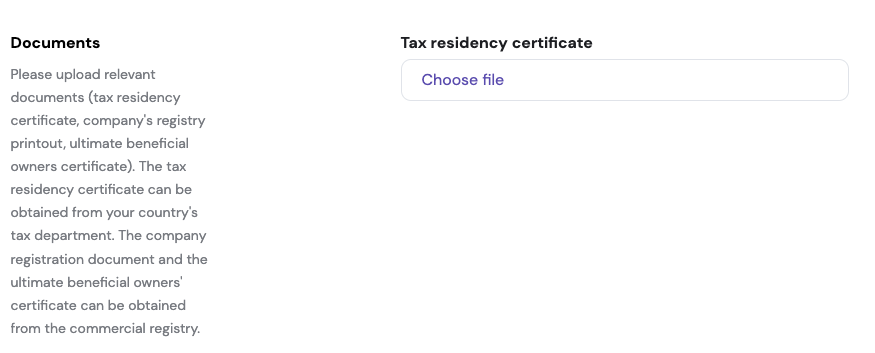

Click on “Choose file” and select the correct file to be uploaded from your computer.

After the file has been uploaded, save your account settings.

Crowdestate’s investor support team will review the uploaded document, and if it qualifies as the tax residency certificate, it will be promptly approved. If the uploaded document does not qualify as the tax residency certificate, it will be rejected, and you will receive an email notification about the rejection.

Can I still invest without having provided the tax residency certificate?

The lack of a tax residency certificate does not prohibit you from investing with Crowdestate in any way. The only downside of investing without the provision of a tax residency certificate is the potential full application of the withholding tax in the foreign country, and in certain cases, that might lead to the excess or double taxation of your investment income.

Therefore it is recommended to have an up-to-date tax residency certificate at hand and upload it to your Crowdestate’s investment account as soon as possible.

What does not qualify as a tax residency certificate?

The following items definitely do not qualify as tax residency certificates:

- Copy of your ID or passport

- Utility bill

- Rental contracts

- Actual tax declaration

- Tax credit statement

- Bank statement

- Your favourite philosophical or otherwise funny meme

- Salary slip

- Social Security status document

- Scan of an empty A4 paper

- Blank template of the tax certificate or tax form

- Letters or reminders from the tax department

- Any text file

- Screenshot of the tax department’s website

- National insurance number or letter

- CV

- Word document or Excel sheet

- Registration certificate

- University diploma

- Photo or video of your pet

Sample tax residency certificates

You will find the selection of sample tax residency documents below. We will continue to upload additional samples to keep the list as exhaustive as possible.

A

Argentina

Australia

B

C

D

E

F

G

H

I

L

M

N

P

R

S

Switzerland (private) (private) (private)

T

Turkey

U

United Kingdom